On this 1 year chart of the NDX we see why the 1280 level has been resistance.....it's the 23.6% Fibonacci re-tracement. The NDX did a textbook double bottom and the neckline is 1280. When 1280 breaks, we'll be looking for next resistance at 1380-1425(38%fib). A way to play this could be with the QLD etf. IF and when we break 1280 will be a buy signal, using a close back below 1280 as a stop loss. We could also go sideways for a few more months.

On this 1 year chart of the NDX we see why the 1280 level has been resistance.....it's the 23.6% Fibonacci re-tracement. The NDX did a textbook double bottom and the neckline is 1280. When 1280 breaks, we'll be looking for next resistance at 1380-1425(38%fib). A way to play this could be with the QLD etf. IF and when we break 1280 will be a buy signal, using a close back below 1280 as a stop loss. We could also go sideways for a few more months.

Saturday, March 28, 2009

NDX more charts

On this 1 year chart of the NDX we see why the 1280 level has been resistance.....it's the 23.6% Fibonacci re-tracement. The NDX did a textbook double bottom and the neckline is 1280. When 1280 breaks, we'll be looking for next resistance at 1380-1425(38%fib). A way to play this could be with the QLD etf. IF and when we break 1280 will be a buy signal, using a close back below 1280 as a stop loss. We could also go sideways for a few more months.

On this 1 year chart of the NDX we see why the 1280 level has been resistance.....it's the 23.6% Fibonacci re-tracement. The NDX did a textbook double bottom and the neckline is 1280. When 1280 breaks, we'll be looking for next resistance at 1380-1425(38%fib). A way to play this could be with the QLD etf. IF and when we break 1280 will be a buy signal, using a close back below 1280 as a stop loss. We could also go sideways for a few more months.

NDX looking for a big move

Sometimes you need to look at a simple line chart with no pivots or moving averages, to see a clear picture. Here, the NDX(nazz 100) has tried 3 times to break through the 1280 level(blue line) only to find resistance(sellers). If and when it does break the 1280 level it could run a fast 100 pts to 1380. Triple tops(1280) seldom hold and usually on the 4th try, resistance should break. Will we get a big pullback first or a another big run higher?

Sometimes you need to look at a simple line chart with no pivots or moving averages, to see a clear picture. Here, the NDX(nazz 100) has tried 3 times to break through the 1280 level(blue line) only to find resistance(sellers). If and when it does break the 1280 level it could run a fast 100 pts to 1380. Triple tops(1280) seldom hold and usually on the 4th try, resistance should break. Will we get a big pullback first or a another big run higher?

Friday, March 27, 2009

Microsoft plays monthly pivots

Microsoft found support on monthly S1 at $14.90(blue circle, green line S1), and has bounced up to monthly R1 $18.74(blue circle , green line R1).

Monthly pivots give swing taders great odds! buy S1 - sell R1 ......pivots give traders entry and exit targets.

S stands for Support

Monthly pivots give swing taders great odds! buy S1 - sell R1 ......pivots give traders entry and exit targets.

S stands for Support

R stands for Resistance

Thursday, March 26, 2009

Alcoa close to resistance.

Alcoa (AA) found support on the monthly S1 pivot(blue circle, green line S1) at $4.97. The chart shows it is close to the Monthly R1 pivot @$8.25 and the red line above it at $8.68(blue arrow) is the 100 day moving average, which should be resistance and the 50% fib. Alcoa is up 62% since hitting the monthly (S1) pivot.

This is a very nice example of pivot power! Buy S1, sell R1

Solar stocks are hot again

TAN is a Solar ETF representing First Solar(FSLR) and many others. All the solar stocks today popped up big time! Look at: JASO, CSIQ, CSUN, ASTI, SOLF, ESLR, etc.....all hard big moves. Look to buy on pullbacks to a moving average(20day or 50 day).

TAN is a Solar ETF representing First Solar(FSLR) and many others. All the solar stocks today popped up big time! Look at: JASO, CSIQ, CSUN, ASTI, SOLF, ESLR, etc.....all hard big moves. Look to buy on pullbacks to a moving average(20day or 50 day).

Bonds

from Bloomberg.com.........The run of strong coupon auctions has come to an end. The size of yesterday's record $34 billion 5-year auction appears to have been too big. Coverage was just above 2 at 2.02, sizably below the long-term average of 2.31, while the stop-out rate was far above expectations, nearly 5 basis points above expectations at 1.849 percent. Non-dealers showed limited interest with indirects taking down a sub-par 30 percent of the offering. Yesterday's results will raise questions over demand for today's $24 billion auction of 7-year notes. Money moved out of Treasuries in immediate reaction to yesterday's auction.

FAZ 3x financials stock

Many traders made a lot of money trading FAZ....a 3x inverse financial ETF. FAZ's March high was at monthly R2 pivot(blue circle at the top of the chart) in early March and now has fallen to under $20 from $112. Next support is $13.50- $15.00 on the Monthly S2 pivot(blue circle bottom of the chart). Monthly pivot points work great for swing traders! They show traders where monthly resistance and support is.

Many traders made a lot of money trading FAZ....a 3x inverse financial ETF. FAZ's March high was at monthly R2 pivot(blue circle at the top of the chart) in early March and now has fallen to under $20 from $112. Next support is $13.50- $15.00 on the Monthly S2 pivot(blue circle bottom of the chart). Monthly pivot points work great for swing traders! They show traders where monthly resistance and support is.

S&P tests support

What a crazy day yesterday. Per my previous days post, the S&P 500 went down to the 50 day moving average(793-blue line) and big buyers stepped in there, and we rallied hard and fast into the close. This is a bullish sign to see big money buying on a pullback to a major moving average. Next major resistance area is 840-850. We have the 100 day moving average there(red line), the 61.8 fib and a major trend line(white line) that should stop this rally for a few days/week.

What a crazy day yesterday. Per my previous days post, the S&P 500 went down to the 50 day moving average(793-blue line) and big buyers stepped in there, and we rallied hard and fast into the close. This is a bullish sign to see big money buying on a pullback to a major moving average. Next major resistance area is 840-850. We have the 100 day moving average there(red line), the 61.8 fib and a major trend line(white line) that should stop this rally for a few days/week.Wednesday, March 25, 2009

Goldman Sachs at resistance

GS hit the yearly pivot at $113 and the weekly r2 pivot. The 200 day moving average is above at $117 (white line).

GS hit the yearly pivot at $113 and the weekly r2 pivot. The 200 day moving average is above at $117 (white line).Tuesday, March 24, 2009

S&P looking for a pullback

The S&P went up to our 820 target yesterday and now the rally has stalled. The market is very overbot and a test of the daily 50day moving average(blue line) could be next. The 50 day has been resistance(white circles) for 3 months. Now that price finally broke above the 50day, a retest of it that holds would be bullish. Why? because that's the spot big money should be buying at. If we see big money come in there, we know this rally has more upside. Watch the 784 area for 1st support and 741(20 day, yellow line) as 2nd support and as the line in the sand for this rally.

The S&P went up to our 820 target yesterday and now the rally has stalled. The market is very overbot and a test of the daily 50day moving average(blue line) could be next. The 50 day has been resistance(white circles) for 3 months. Now that price finally broke above the 50day, a retest of it that holds would be bullish. Why? because that's the spot big money should be buying at. If we see big money come in there, we know this rally has more upside. Watch the 784 area for 1st support and 741(20 day, yellow line) as 2nd support and as the line in the sand for this rally.MOD up 62%

Modine (MOD) is up 62% since I posted it here last week at $1.59, now $2.59. Mod just hit the 38% fib and a little pullback would be normal here, but this should have more upside. I see $3.27 (50% fib) as the next resistance and possibly $4.00(R2). But $2.00 needs to hold on any pullback.

Modine (MOD) is up 62% since I posted it here last week at $1.59, now $2.59. Mod just hit the 38% fib and a little pullback would be normal here, but this should have more upside. I see $3.27 (50% fib) as the next resistance and possibly $4.00(R2). But $2.00 needs to hold on any pullback.Rounding Bottoms

This chart of Evergreen Energy shows what a rounding bottom looks like. The bottom around the .30 cent area shows how price goes sideways after a big fall, and lets the moving averages catch up(blue line=50 day ma). When price popped above the 50 day(blue line) at .45 cents approx. was the buy signal. That's when we see a change(early Feb.) in investor sentiment on this chart.

This chart of Evergreen Energy shows what a rounding bottom looks like. The bottom around the .30 cent area shows how price goes sideways after a big fall, and lets the moving averages catch up(blue line=50 day ma). When price popped above the 50 day(blue line) at .45 cents approx. was the buy signal. That's when we see a change(early Feb.) in investor sentiment on this chart.Dow Chemical Monthly / Yearly S1 pivot was the low

Dow Chemical shows on 3/9 price touched the monthly S1 pivot(1st support, white circle, green line S1) @5.61 and it was the yearly S1(purple line S1) pivot too! Today, Dow's price touched the monthly Pivot (yellow line P) @8.76. Pivots give you great entry and exit targets.

Dow Chemical shows on 3/9 price touched the monthly S1 pivot(1st support, white circle, green line S1) @5.61 and it was the yearly S1(purple line S1) pivot too! Today, Dow's price touched the monthly Pivot (yellow line P) @8.76. Pivots give you great entry and exit targets.

Monday, March 23, 2009

Monday mornings

On Monday mornings, I look at the weekly R1/S1 pivots for the Dow, S&P and NDX futures to tell me what this weeks trading range should be. This coming week, the NQ has a weekly R1 pivot at 1228.50 and a open gap at 1229 and weekly S1 at 1145 and another gap at 1146. So I'm looking for the NQ this week to go from 1230 to 1145 and fill some gaps. Es has weekly R1 at 795 and S1 at 739. Es has a gap open at 820 too (Weekly r2=826). The YM has Weekly r1 @7452 and Ws1 @7047. Sometimes we go from the Weekly pivot point(pp) to weekly r2 or s2. Weekly pivots usually will keep you on the right side of the trade for the week. Weekly pivots can be found at: www.mypivots.com/dn

Sunday, March 22, 2009

Day traders use pivots

The best tool a day trader can use are "floor traders pivots". The gold futures chart above shows on Friday gold open higher and hit the R1 pivot $ 956 and sold off to the S1 pivot $947. Day traders where shorting at $956 and covering at S1 for 10 pt's or $1000 per gold futures contract. Most charting software now has pivot pivots as a study or indicator. Pivots have been around for 50 years and still are used by millions of traders everyday.

The best tool a day trader can use are "floor traders pivots". The gold futures chart above shows on Friday gold open higher and hit the R1 pivot $ 956 and sold off to the S1 pivot $947. Day traders where shorting at $956 and covering at S1 for 10 pt's or $1000 per gold futures contract. Most charting software now has pivot pivots as a study or indicator. Pivots have been around for 50 years and still are used by millions of traders everyday.Pivots are a calculation of the previous days high+low+close/3.

http://www.pivotpointcalculator.com/

Friday, March 20, 2009

Long term investors

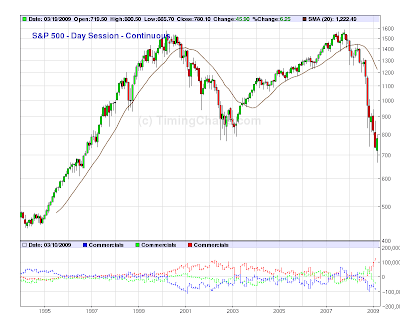

For longer term investors, you only need to look at a monthly S&P 500 chart with the 20month moving average. See in the chart how the 20 month(brown line) was support for many years......and when it broke.....that was the sell signal to get out of all stocks.

For longer term investors, you only need to look at a monthly S&P 500 chart with the 20month moving average. See in the chart how the 20 month(brown line) was support for many years......and when it broke.....that was the sell signal to get out of all stocks.

Thursday, March 19, 2009

Hedge Funds Buy Stocks for First Time

March 19 (Bloomberg) -- U.S. hedge funds are buying more of the nation’s stocks than they’re selling for the first time since October, while mutual funds and most other investors remain net sellers, according to UBS AG.

http://www.bloomberg.com/apps/news?pid=20601110&sid=arJV1.PoxmCU

http://www.bloomberg.com/apps/news?pid=20601110&sid=arJV1.PoxmCU

S&P 500 at resistance

S&P hitting it's head at several resistance points(white circle). Demarks DMH (orange line) , 50 day moving average(blue line), and stochastic is crossing(blue arrow, bottom of the chart), giving a sell signal(short term).

S&P hitting it's head at several resistance points(white circle). Demarks DMH (orange line) , 50 day moving average(blue line), and stochastic is crossing(blue arrow, bottom of the chart), giving a sell signal(short term).Wednesday, March 18, 2009

Auto parts stocks had a big day

Modine MOD nice base and now breaking out. Testing the monthly P today. the 50 day (blue line ) @2.31 above is calling. also look at TRW, LEA, etc.

Modine MOD nice base and now breaking out. Testing the monthly P today. the 50 day (blue line ) @2.31 above is calling. also look at TRW, LEA, etc.S&P 500 at resistance

S&P 500 is now up 18.75% since the 666 low several days ago. This is Quad Expiration week and I was calling for the 800 strike to get pinned before this Friday. The S&P 500 hit 800 today. Thanks Ben Bernanke! Also the daily 50 moving average(blue line) is at 800. The past few months every time the S&P went to the 50 ma(white cirles), it failed there. This should be resistance again........ look for a pullback in a day or two.

S&P 500 is now up 18.75% since the 666 low several days ago. This is Quad Expiration week and I was calling for the 800 strike to get pinned before this Friday. The S&P 500 hit 800 today. Thanks Ben Bernanke! Also the daily 50 moving average(blue line) is at 800. The past few months every time the S&P went to the 50 ma(white cirles), it failed there. This should be resistance again........ look for a pullback in a day or two.NDX coming up too resistance

NQ/ndx has Monthly R1 at 1229(green line) and a open gap there from mid February(white arrow). Also the 76% fib re-tracement is up there. Stochastic too are very overbot as seen in the lower chart. This is a good place to take some profits! We should see a pullback to the 50day moving average(blue line) @1181.

NQ/ndx has Monthly R1 at 1229(green line) and a open gap there from mid February(white arrow). Also the 76% fib re-tracement is up there. Stochastic too are very overbot as seen in the lower chart. This is a good place to take some profits! We should see a pullback to the 50day moving average(blue line) @1181.

Tuesday, March 17, 2009

FAS - banks 3x ETN

FAS the triple long banks ETN is looking good! It will run into 1st. resistance at $6.50 or the monthly P @6.78. Stochastics will be overbot tomorrow as seen in the lower chart. FAS has an open gap at $8.00. ....thats my target! Use the 20 day moving average (yellow line) at $4.53 as a stop.

FAS the triple long banks ETN is looking good! It will run into 1st. resistance at $6.50 or the monthly P @6.78. Stochastics will be overbot tomorrow as seen in the lower chart. FAS has an open gap at $8.00. ....thats my target! Use the 20 day moving average (yellow line) at $4.53 as a stop.SIRI rounding bottom

Siri is breaking out of it's rounding bottom. It could go to the monthly Demark high pivot at .33 or higher!

Siri is breaking out of it's rounding bottom. It could go to the monthly Demark high pivot at .33 or higher!open S&P Mar contracts

As of yesterdays close there are still 326,303 open March full size S&P contracts that expire this Friday. Most of these contracts are short. .........41,461 covered yesterday. On March 6th, there where 550,000 open contracts.

Look for continued bullishness thru Quad Ex this Friday.

Look for continued bullishness thru Quad Ex this Friday.

Monday, March 16, 2009

NQ tests the daily 50

The NQ(NDX) kissed the 50day moving average(Blue line) @1177, and the monthly P (yellow line P) @1167 today, and sold off, like I said it probably would last weekend. Stochastics(lower chart red/yellow lines) are overbot and starting to cross. Look for a possible retest of the the 50day @1177 tomorrow or a pullback to the test the 20 day moving average at 1126.9(yellow line)

The NQ(NDX) kissed the 50day moving average(Blue line) @1177, and the monthly P (yellow line P) @1167 today, and sold off, like I said it probably would last weekend. Stochastics(lower chart red/yellow lines) are overbot and starting to cross. Look for a possible retest of the the 50day @1177 tomorrow or a pullback to the test the 20 day moving average at 1126.9(yellow line)ES kisses the 34e

The ES (S&P futures) kissed the 34e moving average(thin orange line circled) and came close to the monthly p at 775.75(yellow line). Stochastic are now overbot (red/yellow line lower chart). I'm looking for a pullback to test the 20 sma 731(yellow line). I feel this rally could go up to the 50 day moving average(blue line) @795 and possibly the open gap at 820 / Mr1 823.

Merriman on this week

For this coming week, the most notable celestial event we take interest in is the “Sagittarius Factor” of Monday-Wednesday. This is when the Moon makes its 2-1/2 day passage through the sign of Sagittarius. It oftentimes coincides with very sharp price movements – and reversals – in many financial markets, but especially in precious metals, currencies, and Treasuries.

http://www.mmacycles.com/weekly-preview/mma-comments-for-the-week/mma-weekly-comments-for-the-week-beginning-march-16,-2009/

http://www.mmacycles.com/weekly-preview/mma-comments-for-the-week/mma-weekly-comments-for-the-week-beginning-march-16,-2009/

S&P open interest shrinks

As of the close last Friday, there were 367,962 open March contracts that expire this Friday. 52,597 covered last Friday.

Sunday, March 15, 2009

Is Gold going to fail or breakout?

April gold closed Friday with a doji below the daily 20 sma(yellow line) and has support on the daily 50(blue line). A close over 946-950 would be a buy signal with the 20sma as your stop. The monthly pivot point is also at 946. Stochastics are oversold and making a "w"pattern for possible winner.

April gold closed Friday with a doji below the daily 20 sma(yellow line) and has support on the daily 50(blue line). A close over 946-950 would be a buy signal with the 20sma as your stop. The monthly pivot point is also at 946. Stochastics are oversold and making a "w"pattern for possible winner.Euro at resistance?

The Euro closed Friday at the daily 50 sma(blue line). It usually fails on the first test, and it has been a few months since they last kissed. The monthly R1 pivot is at 1.3000 and the daily 100sma (red line) is at 1.3026. Strong support at 1.2703 the daily 20(yellow line).

The Euro closed Friday at the daily 50 sma(blue line). It usually fails on the first test, and it has been a few months since they last kissed. The monthly R1 pivot is at 1.3000 and the daily 100sma (red line) is at 1.3026. Strong support at 1.2703 the daily 20(yellow line).Friday, March 13, 2009

Subscribe to:

Comments (Atom)